Newsletter 12th February 2024

Welcome back to this week's newsletter. There is never a dull moment in tax and as you may recall last time I mentioned that Chancellor Jeremy Hunt had set the date for the Spring Budget for Wednesday 6th March what could he possibly have up his sleeve?

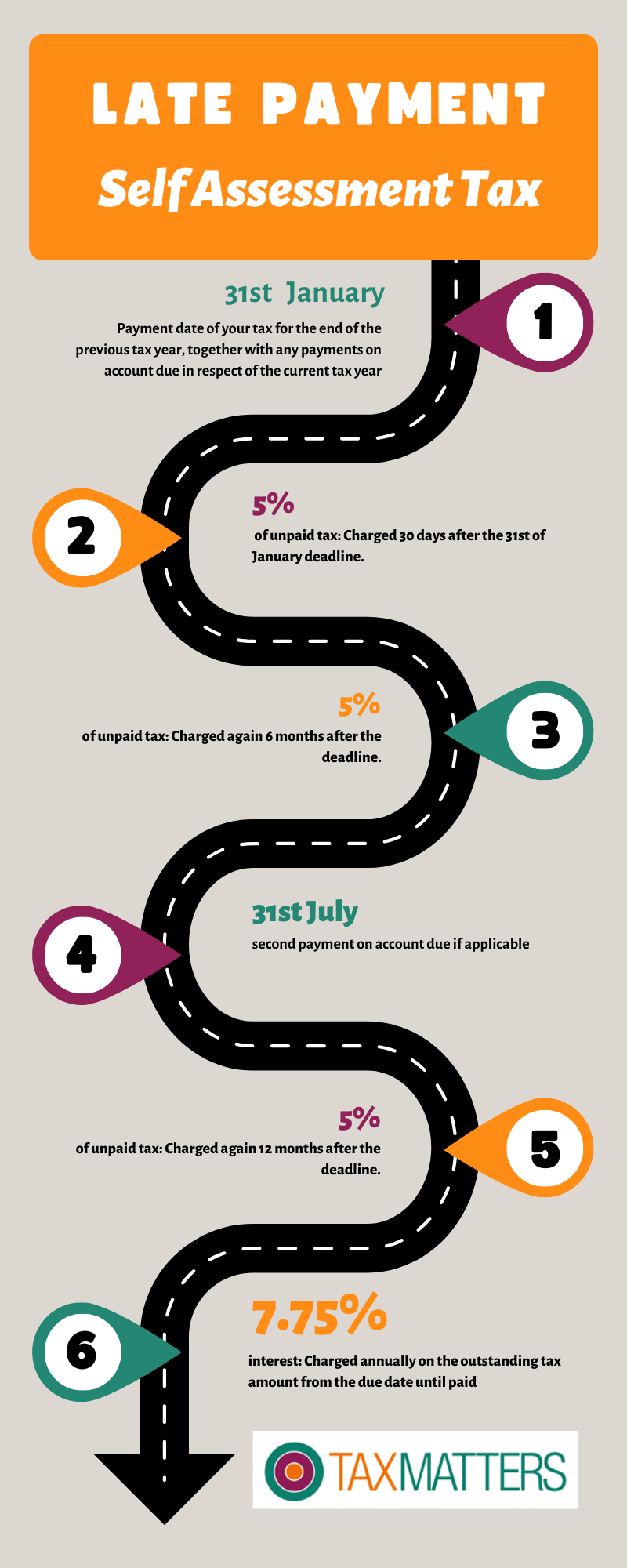

Now that the tax return deadline has passed, our attention needs to turn to paying HMRC and the cost of making those payments late.

Have you heard that Aldi has launched a new beer, and why is that interesting for tax?

Grab yourself a coffee and a biscuit and read on.

High Income Child Benefit Charge:

Do you remember the change to the rules in regards to what my mum used to refer to as “The Family Allowance” back in 2013?

The High Income Child Benefit Charge (HICBC) is a tax charge that applies to families where the highest earner (or their partner) has an adjusted net income of over £50,000 and they receive Child Benefit. In other words, if you qualify for Child Benefit and you or your partner earn more than £50,000, you have to pay this additional tax.

The Association of Taxation Technicians (ATT) recently urged the government to adjust the High Income Child Benefit Charge (HICBC) threshold in this year's Spring Budget. They propose either:

Raising the threshold: To account for inflation since its 2013 introduction, reflecting real income changes.

Aligning with higher rate tax: Matching the HICBC threshold to the higher rate income tax threshold, simplifying administration and focusing the charge on its intended target – higher-income earners.

Both options would exempt basic rate taxpayers from the HICBC, aligning with its original policy intent. Additionally, aligning the thresholds offers practical simplification benefits.

With only weeks to go until the Budget, I anticipate that this will become the dominating news story, lets wait and see.

The Cost of an Honest Mistake:

It may seem unbelievable to many that some people do not pay their self-assessment on the due date of 31st January. Unfortunately, there are a significant amount of people who do not simply because they have not got the funds, or they forget.

HMRC are very supportive and offers *Time To Pay Arrangements” and I would urge anyone struggling to take advantage of this facility.

When advising clients of their tax positions I always remind them to save the money and to make a mental note that after Christmas there is an awful job to do “paying your tax”.

In the infographic below, you can see the charges and interest that HMRC will apply against late payments, if you haven’t paid yet I suggest you reduce these charges and contact HMRC today

“Drown before you get drunk”

What a great phrase, I had never heard this saying until a friend recently mentioned it when we talking about the strength of beers. What does that mean I enquired, “You never used to get strong beer years back, in fact, you would have to drink so much to get drunk you would possibly drown first”.

I laughed and then the landscape changed.

Aldi' has just launched a 3.4% beer, cleverly named "Hop Forward," which has caused ripples in the British beer scene. This strategic move coincides with the UK government's 2023 alcohol duty reform, introducing a two-tiered system that favours lower-alcohol brews. But does this single beer raise the bar for further tax incentives, or is it merely a hop in the right direction? Let's uncork the complexities.

The Fiscal Fizz: A Two-Tiered Tax Tale

The 2023 reform slashed duty rates for beers under 3.5% ABV by nearly 60%, while maintaining higher rates for stronger contenders. This policy aims to curb harmful drinking and promote healthier choices. However, it also presents an enticing opportunity for businesses to capitalize on a newly tax-advantaged market segment.

Aldi's Calculated Hop:

Enter Aldi, the budget supermarket giant, with its strategically crafted 3.4% beer. "Hop Forward" sits right at the sweet spot, maximizing the tax benefit while offering a hoppy flavour profile often associated with stronger brews. This move demonstrates Aldi's awareness of the new duty landscape and its intent to tap into a potentially lucrative market.

Raising the Bar...or Just Tipping Over?

So, does this single beer signal an imminent flood of similar offerings and a push for further tax cuts? Perhaps not. While Aldi's move is smart, it remains to be seen if other major breweries will follow suit. Consumer preferences still play a crucial role. Will they embrace lower-alcohol options readily, or will the taste factor trump financial savings?

Beyond the Fiscal Foam: Considerations and Cautions

While the tax reform and Aldi's beer raise interesting questions, further incentives require careful consideration.

Health Concerns: Lower-alcohol beers might inadvertently encourage increased overall consumption, potentially negating the intended health benefits.

Market Saturation: A sudden influx of 3.4% options could saturate the market, stifling innovation and variety beyond this specific alcohol level.

Producer Realities: Smaller breweries might struggle to compete with large retailers like Aldi, potentially harming diversity within the industry.

The Future on Tap: A Fermenting Discussion

Ultimately, the impact of the alcohol duty reform and Aldi's "Hop Forward" remains to be seen. While it's unlikely to single-handedly trigger a wave of further tax breaks, it has undoubtedly sparked a conversation. The success of lower-alcohol options, consumer preferences, and potential policy adjustments will collectively determine the future direction of this market segment.

This is just the first sip of a complex debate. Whether Aldi's beer has truly "hopped forward" towards a new era of lower-alcohol incentives or simply sparked a fleeting trend remains to be seen. Only time, and perhaps another strategically crafted, lower-ABV brew, will tell the tale. So, raise a (responsible) glass and stay tuned as the story unfolds!

Everyone is looking at ways to reduce their personal tax liabilities, and none more so than property landlords or "Buy to Let" landlords.

In recent years they have seen significant reductions in allowable expenses which mainly focus on the withdrawal of mortgage interest. With mortgage rates creeping up over the last year what else can be claimed to help out?

Hopefully, the short video will make you aware of some of the lost opportunities available.

This week I am off on a well-deserved break after the January tax return season, and much to the family's delight I am taking a record player and box of 45s (vinyl singles) with me.

I wouldn't want you to miss out so I have added a selection of the singles in the box to this week's Spotify playlist.

A real mixed-up selection of all-time favourites from the Jam and Style Council, and some oldies and new purchases (Racheal Maxann)

I hope you have enjoyed this edition of the newsletter, if you have any suggestions or comments then please let me know it is always good to hear from you.

In addition to the newsletter, I have also started adding blogs to the website, so please take a look.

If I or the team can be of any assistance to you, your family or your friends then please do not hesitate to contact me